To counter this Russia has built up a large ‘shadow fleet’, which are mostly old Greek tankers with opaque ownership and no Western ties in terms of finance or insurance - and therefore not subject to the price caps, there by enabling Russia to sell oil well above the price cap. This is driving Russia’s oil revenue higher year on year.

In February, 45% of Russian oil and its products were transported by tankers subject to the oil price cap. The remainder was shipped by ‘shadow’ tankers and was not subject to the price cap policy.

65% of Russian crude oil was transported by ‘shadow’ tankers, while tankers owned or insured in countries implementing the price cap accounted for 35%.

‘Shadow’ tankers transporting oil products handled 41% of Russia’s total volume of products. The remaining volume was shipped by tankers subject to the price cap policy.

Tankers in the Pacific region were loaded with Russian oil at ports like Kozmino in Russia, where the ESPO pipeline ends and is connected to a refinery. Here, the ESPO crude oil grade is exported at prices exceeding the cap.

Russia’s reliance on EU/G7 owned or insured vessels provides the Price Cap Coalition with adequate leverage to lower the price cap and implement better monitoring and enforcement that would considerably lower Russia’s oil export revenues.

To reduce Russian revenue in oil - Europe needs to stop buying Russian fossil fuels and the price cap needs to be lowered.

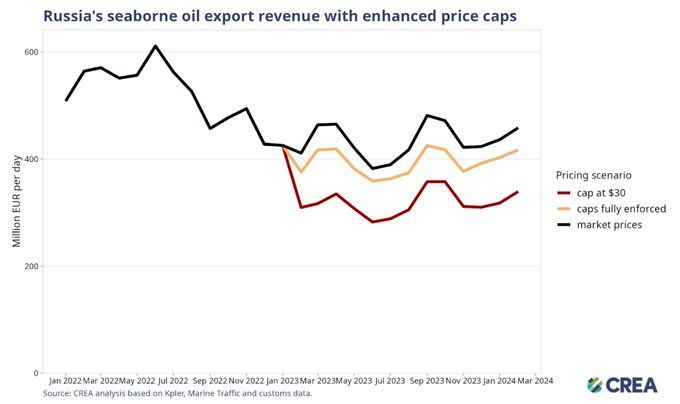

A price cap of USD 30 per barrel (still well above Russia’s production cost that averages USD 15 per barrel) would have slashed Russia’s revenue by EUR 46 bn (25%) since the sanctions were imposed in December 2022 until the end of February 2024. February alone would have seen a reduction of EUR 3.45 bn (26%) with a USD 30 per barrel price cap.

Lowering the price cap would be deflationary, reducing Russia’s oil export prices and inducing more production from Russia to make up for the drop in revenue.

Since introducing sanctions until the end of February 2024, thorough enforcement of the price cap would have slashed Russia’s revenues by 9% (EUR 15.81 bn). In February alone, full enforcement of the price cap would have slashed revenues by 9% (approximately EUR 1.2 bn).

Enforcement agencies overseeing the sanctions must take proactive measures against violating entities, including insurers registered in price cap coalition countries, shippers and vessel owners. Despite clear evidence of violations, there must be more information on enforcement agencies implementing penalties against shippers, insurers, or vessel owners in the public domain. Penalties against violating entities increase the perceived risk of being caught.

OFAC should continue sanctioning vessels that have violated the price cap policy. Other enforcement agencies, such as the OSFI, should ramp up investigations of entities that appear to have violated sanctions.

Penalties for those guilty of violating the price cap must be significantly harsher. Current penalties include a 90-day ban of vessels from securing maritime services after violating the price cap, a mere slap on the wrist. Vessels should be fined and banned in perpetuity if found guilty of violating sanctions.

The lack of proper monitoring and enforcement and rising oil prices have increased Russia’s export revenues to fund its war against Ukraine.

3/4 Next

Call to Action! Please support this call