In February 2024 - The EU’s imports of fossil fuels from Russia consisted of pipeline gas (39% worth EUR 0.7 bn), LNG (31% worth EUR 0.55 bn), crude oil (30% worth EUR 0.53 bn), and oil products (EUR 0.15 bn). This is around €2 Billion in revenue for the month, equivalent to €24 Billion a year!

Landlocked Central and Eastern European countries and some Southern European countries received Russian fossil gas via pipeline through Ukraine and TurkStream in February 2024. Crude oil was obtained via the Druzhba oil pipeline. The EU has not banned fossil gas and crude oil via pipelines.

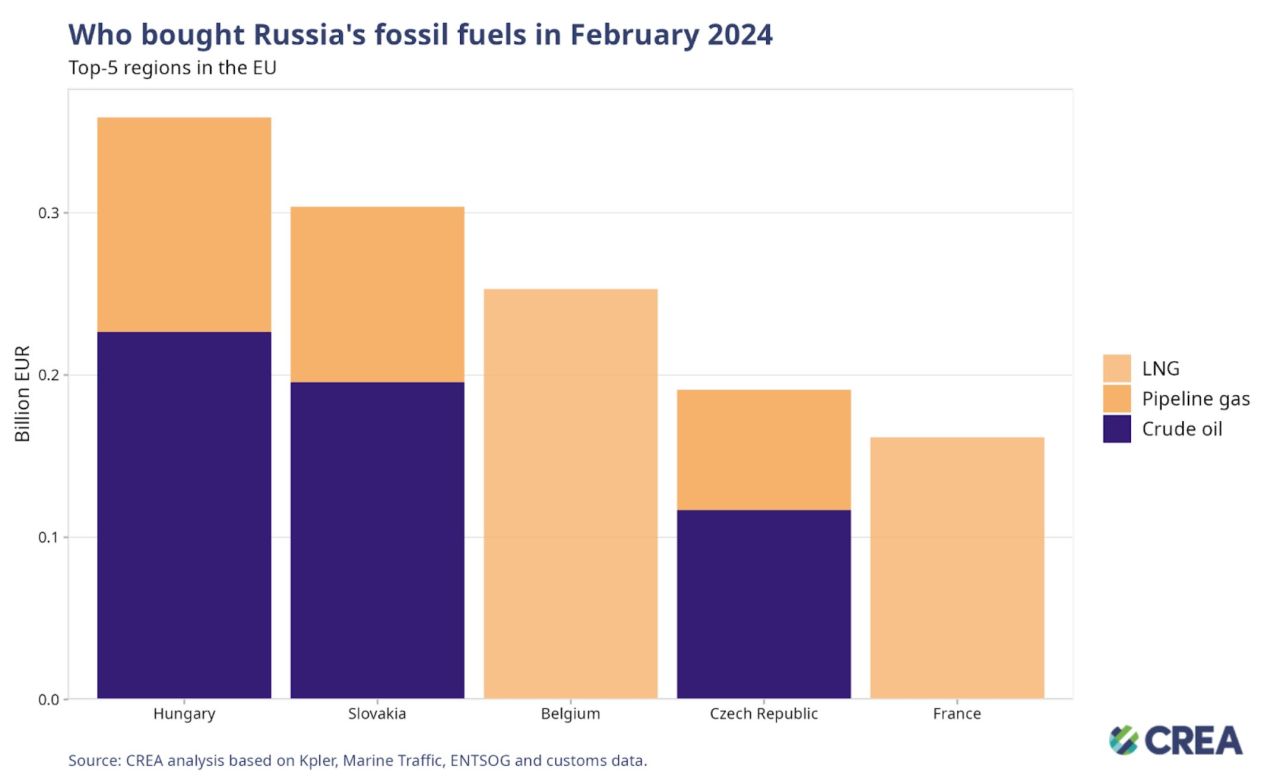

Hungary was the largest importer of Russian fossil fuels within the EU in February, importing fossil fuels worth EUR 253 mn. Imports comprised of crude oil and gas, delivered via pipelines, valued at EUR 226 mn and EUR 132 mn, respectively. While there was a marginal month-on-month decrease in Hungary’s pipeline gas imports from Russia, crude oil imports saw a sharp 23% (EUR 42 mn) rise.

Despite a 10% (EUR 12 mn) drop in pipeline gas imports, Slovakia’s imports of Russian fossil fuels rose by 4% (12 mn) in February. Their increased imports of crude via pipeline (14% worth EUR 24 mn) more than made up for the difference.

Belgium’s entire imports of Russian fossil fuels in February consisted of LNG valued at EUR 253 mn. While Belgium’s total volume of LNG imports rose by a mere 4%, their imports from Russia saw a much more significant 44% rise. In February, Belgium’s LNG re-exports rose by a massive 81%, with a significant portion directed towards Spain and China. Almost half of Belgium’s total imports of LNG in February were subsequently exported to other countries, pointing towards the country’s role in transhipping Russian gas across Europe.

The Czech Republic was the EU’s fourth-largest importer of Russian fossil fuels, importing EUR 116 mn of crude oil and EUR 0.74 mn of pipeline gas. While their imports of Russian crude rose by 12% (EUR 12 mn), their imports of gas via pipeline dropped by 17% (EUR 15 mn).

In February, France was the EU’s fifth-largest importer of Russian fossil fuels. The majority of their imports consisted of LNG valued at EUR 161 mn. Despite a 12% rise in total monthly LNG imports to France, Russian LNG imports dropped by 40%, substituted by LNG from the USA.

Russian revenue from Oil in 2024

Oil accounts for roughly one-third of tax receipts and half of all export revenue. The Kyiv School of Economics estimates that Moscow made $178bn from oil sales last year and that revenues could rise to $200bn in 2024 – not far off the $218bn earned in 2022.

Last month, the majority of Russian Urals were sold above $60. But, Western countries have been clamping down, since a reported information request from the US Treasury to shipping companies suspected of violating the cap.

2/4 Next The Price Cap FOLLY.