The Rise of South Africa’s Crypto Elite

South Africa’s crypto ecosystem has been marked by both opportunity and scandal, with two infamous cases standing out:

Mirror Trading International (MTI): From Fortune to Fraud

Launched in 2019, MTI promised investors massive returns through automated Bitcoin trading. By 2020, it had collapsed, leaving over 100,000 investors across 140 countries defrauded of more than $1 billion.

Founder Johann Steynberg fled the country, leaving behind one of the world’s largest pyramid schemes.

Africrypt: The $3.6 Billion Heist

In 2021, Africrypt, another South African platform, made headlines when brothers Ameer and Raees Cajee disappeared, allegedly taking $3.6 billion in Bitcoin with them.

Despite ongoing legal investigations, the funds remain missing, with suspicions of offshore laundering.

These scandals didn’t just leave financial wreckage—they also gave rise to a new class of crypto billionaires whose wealth has quietly influenced South Africa’s media, politics, and international relations.

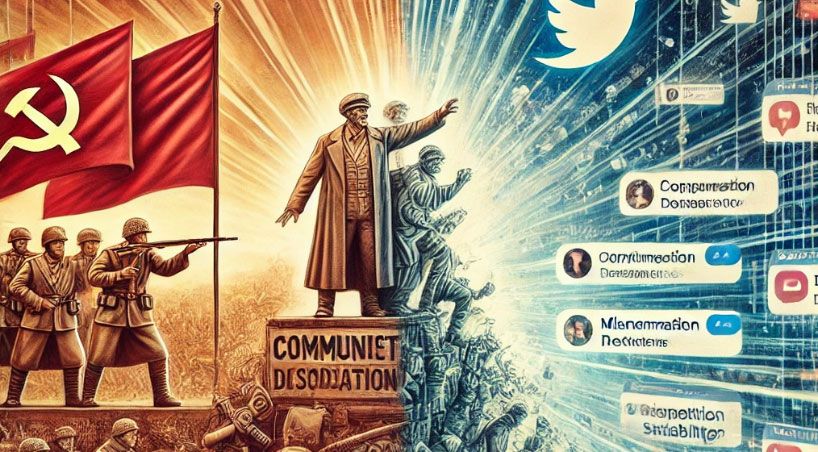

The Kremlin Connection: Crypto as a Weapon of Influence

Russia’s strategic use of cryptocurrency as a geopolitical tool has drawn global attention. For South Africa, the connection lies in overlapping financial networks and ideological narratives:

Crypto Laundering and Sanction Evasion

South Africa has been identified as a potential hub for laundering stolen funds and evading sanctions through cryptocurrency. Russian-linked exchanges and laundering schemes have reportedly facilitated the movement of billions in untraceable transactions.

Ruja Ignatova’s Cape Town Hideout

One of the most intriguing figures in the global crypto ecosystem, Ruja Ignatova—known as the "Cryptoqueen" for her role in the $4.5 billion OneCoin scam—is believed to be hiding in Cape Town.

Her presence raises questions about South Africa’s role as a safe haven for crypto-linked fugitives and its potential ties to Russian-backed operations.

Buying Influence: Crypto and Media Control

Propaganda and Media Ownership

As crypto billionaires expand their wealth, some are moving into media ownership, shaping public opinion and narratives:

- Content Patterns: Far-right and pro-Russian themes have been detected in media outlets suspected of crypto elite influence.

- Disinformation Channels: Local outlets have amplified global Kremlin narratives, including anti-Western sentiment and skepticism about NATO’s actions in Ukraine.

Political Connections: Funding Far-Right Movements

Crypto billionaires’ financial power has extended into South African politics, particularly in support of far-right and nationalist movements:

- Anti-Western Rhetoric: These movements often align with Kremlin-backed narratives critical of Western influence.

- Grassroots Mobilization: Following financial losses from schemes like MTI, many South Africans joined anti-globalist political groups, creating fertile ground for ideological manipulation.

The Tax Haven Problem

The South African Revenue Service (SARS) has been ramping up efforts to crack down on undeclared cryptocurrency holdings. However, many crypto billionaires use offshore accounts and unregulated exchanges to avoid detection.

Recent international agreements may bring these accounts to light, but enforcement remains a challenge.

Implications for South Africa and the World

For South Africa

- Democratic Erosion: The convergence of wealth, propaganda, and political influence threatens to undermine South Africa’s democracy.

- Economic Instability: High-profile crypto scams have shaken trust in the financial system, with ripple effects on the broader economy.

For the World

- Sanctions Evasion: South Africa’s crypto networks risk becoming critical nodes in Russian efforts to bypass international sanctions.

- Disinformation Amplification: The use of crypto wealth to fund media and political influence campaigns has global ramifications, exacerbating geopolitical tensions.

Conclusion: A Call for Action

South Africa’s cryptocurrency boom is more than an economic story—it’s a cautionary tale of how unregulated digital wealth can reshape societies, destabilize democracies, and serve as a tool for foreign influence.

To combat these risks, South Africa must enforce stricter regulations on cryptocurrency, increase transparency in financial systems, and hold crypto elites accountable.

The global community, too, has a role to play in preventing cryptocurrency from becoming a haven for disinformation and corruption.

The stakes are too high to ignore.